Bitcoin is a prime avenue for laundering money. At least that’s the narrative the mainstream media has been feeding the public. Money laundering is probably as old as the invention of money itself. By definition, to launder cash is to make ill-gotten gains appear as if it were all earned legitimately, regardless of whether you’re the leader of a drug smuggling ring, a warlord, or simply can’t help yourself to your rich aunt’s purse.

The anonymity of the internet has emboldened fraudsters into ever-more intricate ways of getting their loot out of the hands of the authorities. And to their credit, the ingenuity of some scammers is mind-boggling. As a cryptocurrency enthusiast, it pays to keep your eyes on the ball if you’re going to be playing around with the technology. With that in mind, let’s take a look at some cryptocurrency crime making the rounds and see what you can do to stay safe.

The Bitcoin Money Laundering Scams

Sim Swapping

In a digital world, society has become accustomed to using devices for identity management. This typically means validating your private accounts, like banking and cryptocurrency exchanges, via smartphone. Sim swapping is a fairly new form of fraud in which impersonators contact your phone provider hoping to transfer your mobile number to another SIM card they’ve recently acquired.

Image courtesy of PublicDomainPictures.

The confident tricksters lay the foundation for this type of scam through social engineering. They gather as much personal information about you as possible before contacting a company representative, answering security questions along the way.

If you’ve ever had to deal with these security questions personally, you’ll know they’re not particularly difficult to answer. Sim swapping is quite lucrative for Bitcoin launderers because it allows them to move illicit funds through legitimate accounts, at least temporarily.

What to Do About It

Whenever you use your phone to authenticate your identity, you’re using something called two-factor authentication (or 2FA, for short). Unfortunately many services, including banking, still rely on SMS for authentication. Obviously, SMS is subject to the sim swapping risks mentioned above.

More secure methods like authenticator apps or hardware devices are highly recommended for sensitive accounts. A fraudster would have to physically get a hold of your device before they could impersonate you. Not impossible but much more secure. Check out our detailed 2FA article for more details.

Ransomware

Ransomware typically involves hackers gaining access to an unsuspecting victim’s computer. In severe cases, however, it can affect an entire city’s infrastructure. Once an attacker gains access to your machine, they will encrypt your data and demand a ransom to unlock it. Payment is usually required in crypto. Though, savvy readers will know that Bitcoin isn’t particularly anonymous to begin with. But that won’t stop the scammers as there are a multitude of coins out there and different ways to cover your tracks.

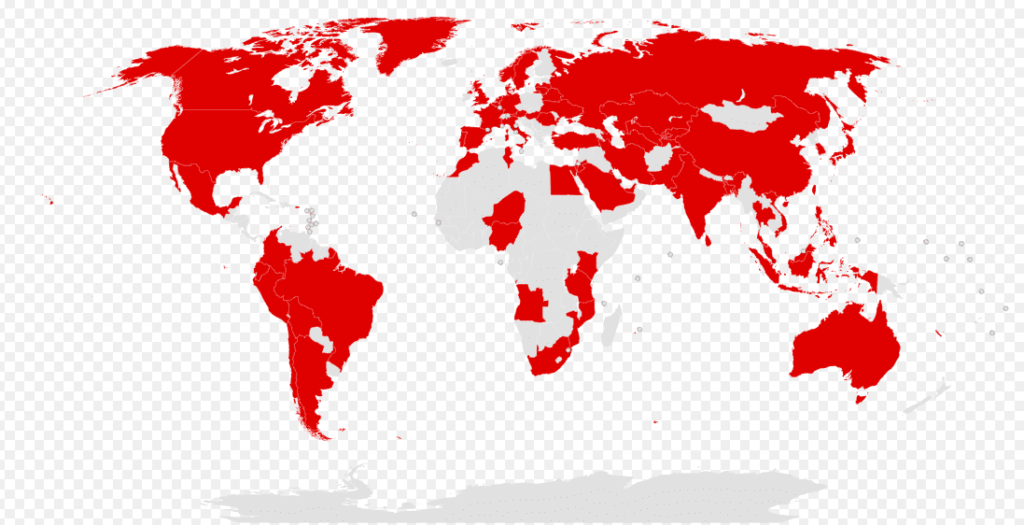

A severe example of this occurred in 2017 when the WannaCry cryptoworm targeted computers running Windows operating systems. The attack affected an incredible 200,000 computers across 150 countries before Microsoft was able to patch the problem.

Image courtesy of Wikipedia

What to Do About It

The most important way to protect against this kind of extortion is to practice healthy internet hygiene. Yes, you read correctly. Taking care of your personal health involves hard work. Exercise, healthy eating, adequate sleep, etc. The same attitude applies when using the web.

Don’t post sensitive information on social media channels, back up valuable data like photos and work documents to external devices on a regular basis, educate yourself on the latest phishing scams, and keep your system updated. You get the picture.

Unregulated Cryptocurrency Exchanges

Blockchain tracking outfit CipherTrace estimates that around $2.5 billion worth of dirty Bitcoin has been washed clean through unregulated exchanges. These exchanges do not comply with Know Your Customer and Anti-Money Laundering laws. According to one CipherTrace study, unregulated exchanges also received the most amount of laundered Bitcoin.

In addition, over-the-counter services and decentralized exchanges also offer users an opportunity to exchange crypto in an anonymous fashion. Many of these services are difficult to track. However, liquidity can be an issue, preventing large transfers from taking place. Measuring these services’ impact on Bitcoin money laundering is difficult at best.

What to Do About It

Hardcore crypto enthusiasts love to complain about centralized services and corrupt authorities. If you’ve ever been subject to scams or crypto-related crime, you’ll know that regulated authorities have one major benefit: you have a higher chance of reclaiming your funds.

Stick to reputable exchanges. There’s a much lower chance your account could be hijacked for laundering purposes.

The Cleaning

These are just a few examples of how criminals obtain dirty money in the first place. But how do they clean it? A common approach is called mixing. Bitcoin mixers apparently clean dirty crypto by bouncing it between several wallet addresses before recombining the full amount. The final address often ends up on the dark web, which is difficult to trace. This process is also called tumbling and various providers offer this as a service, for a fee of course.

It’s important to note that research has found this approach to be quite ineffective for Bitcoin money laundering. It’s not surprising then that other coins like Monero have sprung up to offer serious privacy features where Bitcoin fails. As for other methods beyond mixing, who knows. The experts may never reveal their secrets.

Bitcoin Money Laundering – Final Thoughts

Bitcoin is still a young technology with a relatively small market cap in comparison to traditional currencies. The majority of people, including criminals, earn in fiat currencies like the dollar or euro, first and foremost. The mainstream media may be missing the entire point when it comes to the whole Bitcoin money laundering debate.

In other words, it’s important to make a distinction. Just about anything can be used to launder money: cars, businesses, property, crypto, or even rich aunt purses. Bitcoin is just a tool, a medium of exchange.

Throwing the baby out with the bathwater isn’t a viable solution. If that were the case, society would’ve been burning $100 bills at the fireplace every evening. That said, as highlighted above, there are obviously still risks when dealing with crypto. Make sure you’re not on that laundry list.

This article by Ryan Smith was previously published on Coincentral.com

About the Author:

Ryan Smith is a web designer, writer, and cryptocurrency trader who hails from sunny South Africa. He eats, breathes and lives crypto. With personal experience in foreign exchange & crypto market trading he is always trying to understand the bigger economic picture. When not meticulously looking over charts he can be found planning his next road trip or running around a 5-a-side soccer field.

Featured Image Credits: Pixabay