As far back as 2012, companies were starting to experiment with Bitcoin payments as an alternative to mainstream solutions. In the years following those early tests, companies have jumped on and off the crypto bandwagon trying to figure out if a new wave of consumers would flock to virtual currencies. Tourism is one of those industries where Bitcoin could make a real difference. Money changing hands across borders has always been a tricky business. Who wants to deal with multiple currencies, confusing exchange rates, getting ripped off on those rates, or handling large amounts of foreign cash? Many of these issues are now coming to a head as cryptocurrencies challenge the fundamental idea of border-based financial systems.

The Good

Cryptocurrency is one of the more convenient and cheaper ways to transfer funds internationally, particularly if you’re in a country with sticky capital controls. It’s not uncommon for central banks and clearing houses in these countries to pile on the red tape and deny payments without seeking a hefty cut. The middleman is still alive and well.

With cryptocurrency, you can book and pay for an international holiday in 30 minutes or less (depending on how busy the blockchain you’re using is, of course). No clearance is required. International wire transfers, on the other hand, can easily take around a week to clear. Not so good if you’re abroad and need to send money fast.

“But credit cards solve that problem,” I hear you say. That may be true to some extent. However, credit cards have a couple of problems for traveling wannabes. Firstly, they can be insanely expensive: account charge, finance charge, cash advance, balance transfer, interest, foreign transaction, you name it they’ll charge you for it. Secondly, when you’re off the beaten path it’s highly unlikely you’ll run into someone with a card machine. These machines usually also carry their own, sometimes rather large, expenses with them.

There’s little incentive for small and sleepy destinations to pay for unnecessary systems. Credit cards are features of highly banked western economies. Everywhere else? A simpler, more accessible solution is required. With a smartphone and an internet connection just about anybody can create the next Bitcoin hotel.

Crypto Town

Speaking of small and sleepy, Agnes Water in Eastern Australia has taken the plunge and crowned itself as Australia’s first “Digital Currency Town”.

Over 30 local businesses including restaurants, tour operators, hotels, and guest houses have warmed up to the idea because, well:

“If it’s going to take cryptocurrency to get tourists to town, then bring it on.”

Wise words from Moondoggie Beach and Bush Tours owner Arty Cipak. Tourism is a tough business because it’s cyclical and relies heavily on disposable income and good marketing. It’s also Agnes Water’s primary industry, like so many other smaller towns around Australia and indeed the world. Catering to the tech-savvy younger traveler who’s in touch with cryptocurrencies is a smart move.

The Bad

The immutability of the Bitcoin ledger is both a really neat feature and a potentially annoying problem, depending on your point of view. No more fraudsters rolling back on credit cards transactions. Great. Though, what happens if you send funds to the wrong person or business, or your glamorous tour operator turns out to be an exit scam? Unless you’ve got some Samuel L. Jackson-level negotiating skills or the recipient is a saint, your money is gone and it ain’t coming back. This is decentralization in action folks, nobody’s going to step in to recover your funds.

Then there’s the obvious problem that first-mover coins are currently facing with day-to-day transactions. Let’s paint a picture: You happen to be in a busy downtown food market in Bangkok at the peak dinner hour. Which street vendor is going to wait 30 minutes for you to confirm a Bitcoin transaction? None. You’re going to have to pull out some cold hard cash if you want a taste of that yummy Pad Thai. Now there are developments in progress to change that, but for the immediate future, a lot of locals still consider cash (the paper kind) to be king.

The Future of Bitcoin Tourism

Opinions vary widely on the effectiveness of cryptocurrency in the tourism industry to date. On one hand, budding crypto-preneurs are looking to capitalize on one of the most border-shattering financial developments in decades. On the other, skeptics cite the lack of price stability as one stumbling block for everyday use.

Consider the airline industry. The number of companies that actually accept Bitcoin for flights is not substantial. That said, there are a few who are taking on the risk and have, in fact, been around for quite a few years already.

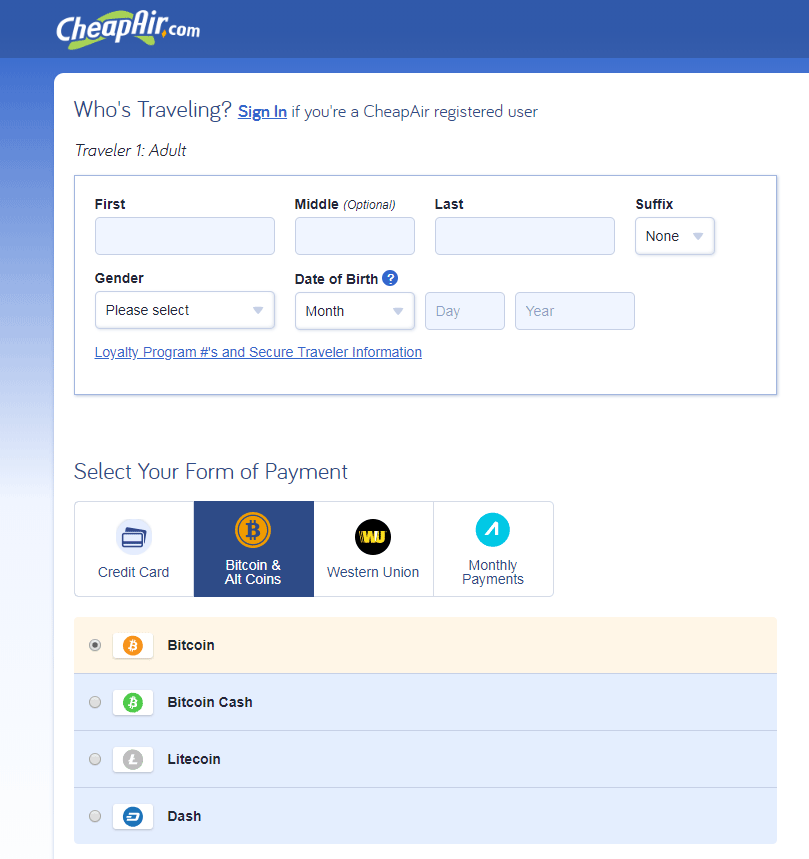

The Latvian carrier airBaltic has been accepting cryptocurrency payments via Bitpay since 2015. CheapAir, a US-based bookings platform has been accepting crypto since 2013. Last year (2018) they added Bitcoin Cash, Litecoin, and Dash to their growing list of payment options.

The tourism industry presents some unique challenges that crypto is very well suited for. There really is no universal payment solution because there are just so many different ways to exchange value when crossing borders. For now, it seems that multiple payment options will remain. It’s highly doubtful that it will stay that way for much longer.

An army of programmers are flocking to crypto, and they’re hungry not only for money but for a new way to program it. Scaling, speed, security: these are all issues they are frantically working on as we speak. Now all that’s required is a healthy dose of cryptocurrency adoption. What industry better to lead the charge than tourism?

Perhaps one day you’ll hear tales of adventurous families exploring the world. While driving down a back-road of an undiscovered country you hear a conversation go:

Son: “Dad are we there yet?”

Father: “No son but we’ll be there in five minutes. Could you please pay the guesthouse before we arrive? The owner said he only accepts Bitcoin.”

This article by Ryan Smith was previously published on Coincentral.com

About the Author:

Ryan is a web designer, writer, and cryptocurrency trader who hails from sunny South Africa. He eats, breathes, and lives crypto. With personal experience in foreign exchange & crypto market trading, he is always trying to understand the bigger economic picture. When not meticulously looking over charts he can be found planning his next road trip or running around a 5-a-side soccer field.