LEO is a utility token that you can use on all iFinex platforms, including Bitfinex and Ethfinex. The token derives its name from “Unus Sed Leo,” iFinex’s company motto. The Latin phrase describes a story in which a sow berates a lion for having only one child. The lion agrees in response but states that the one child is a lion, arguing for quality over quantity.

In this short and simple guide, we’ll cover:

How Does LEO Work?

In the same vein as Binance Coin (BNB), iFinex gives discounts to LEO users and burns tokens on set dates.

LEO Utility

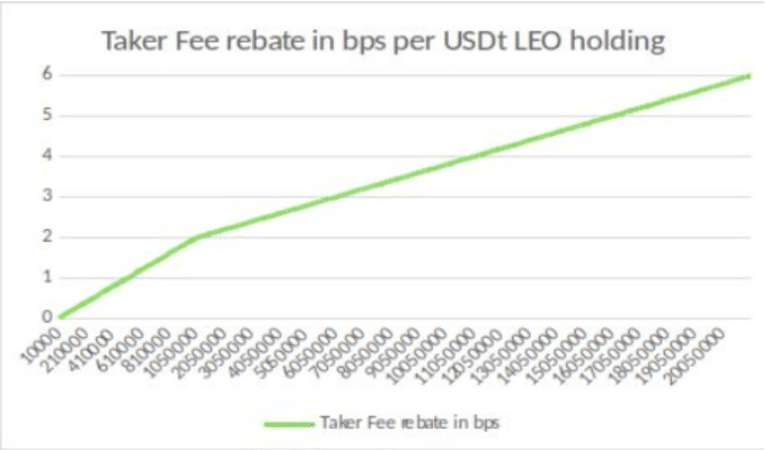

If you hold LEO, you automatically receive a 15 percent taker fee discount on any trade that you make. LEO balances greater than $5,000 earn an additional 10 percent discount on taker fees. Beyond that level, the more tokens you hold, the higher your markdown.

Your discounts increase as you continue to hold more tokens. | Source: Whitepaper

iFinex also collects 25 percent of your trading fee in LEO, if you hold any.

Other discounts you gain for holding LEO include:

- Up to a 25 percent discount on crypto deposits and withdrawals

- Up to a five percent discount on peer-to-peer finance lending

- Future discounts on upcoming iFinex platforms

Token Burns

Each month, iFinex purchases several LEO tokens from the market that equals, at minimum, 27 percent of the consolidated gross revenue of the previous month. The company will continue these monthly burns until no more tokens are in commercial circulation.

iFinex has already burned a significant amount of tokens in the last month. | Source: Token website

Additionally, iFinex will use 80 percent of the funds it recovers from the 2016 Bitfinex hack and 95 percent of the money it gets back from the 2018 Crypto Capital seizure to buy and burn more LEO.

Trading

iFinex held an initial exchange offering (IEO) for LEO in May (private sale) and June (public sale) this year. The company sold one billion tokens for one USDT each.

LEO has quickly risen in the market cap rankings, sitting at number 13 at the time of this writing. As for the price, it’s steadily grown since the IEO, reaching a high of $1.98 on June 12. Currently, the price is bouncing around $1.90.

With token burns continuing to decrease the supply and higher demand due to new products and user growth, the price should continue to rise. The cryptocurrency market isn’t always rational, though, so it’s possible the opposite may come to fruition.

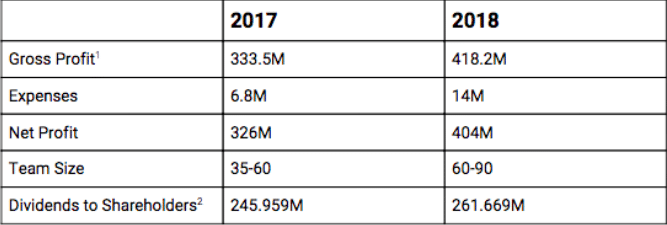

iFinex managed to grow profits even in 2018’s bear market. | Source: Whitepaper

Roadmap

The iFinex team hasn’t included many details about the future utility of LEO. They do make clear, however, that future products will give discounts and additional benefits to LEO holders.

In the whitepaper, iFinex outlines several platforms on the horizon. Any day now, you can expect the launch of eosfinex, a decentralized exchange (DEX) on the EOS blockchain.

iFinex also plans to host pre-vetted token sales on an IEO platform in both Bitfinex and Ethfinex. One of the company’s loftier goals is to release a completely licensed and regulated securities exchange.

Smaller platforms on the roadmap include:

- Dazaar, a decentralized data marketplace

- Betfinex, a legally-compliant betting platform

- μFinex, a suite of tools and libraries to build exchanges and derivatives markets

Where to Buy LEO

Obviously, the most popular platform to purchase LEO is Bitfinex. It’s available as a trading pair with USD, USDT, EOS, BTC, and ETH on that exchange.

If you’re looking for another option, it’s also available on OKEx and IDEX.

Final Thoughts

If you’re a fan of BNB, you probably see great things in LEO as well. The coin’s utility spans across every product in the current (and future) iFinex suite. On top of that, iFinex schedules monthly burns, which should give some support to the token’s price.

That being said, some crypto community members are skeptical of LEO due to Bitfinex and Tether’s sketchy past – and rightfully so. While the token’s fundamentals look good on paper, you should approach this investment with a cautious eye.

Additional Resources

This article by Steven Buchko was previously published on Coincentral.com

About the Author:

Based in Austin, TX, Steven Buchko is the Executive Editor at CoinCentral. He’s interviewed industry heavyweights such as Wanchain President Dustin Byington, TechCrunch Editor-in-Chief Josh Constine, IOST CEO Jimmy Zhong, Celsius Network CEO Alex Mashinsky, and ICON co-founder Min Kim among others. Outside of his role at CoinCentral, Steven is a co-founder and CEO of Coin Clear, a mobile app that automates cryptocurrency investments. You can follow him on Twitter @TheRealBucci to read his “clever insights on the crypto industry.” His words, not ours.