Derek Capo is CEO of TokenPay, the company behind the TPAY blockchain. Capo and TokenPay have been gaining significant attention due to their partnership with the Litecoin Foundation.

They notably transferred a stake that they bought in WEG Bank AG to the Foundation in exchange for technical and strategic assistance. Given the Foundation’s recent exciting announcements on improving the privacy and fungibility of Litecoin, Capo hopes that TokenPay can learn from these moves.

Derek Capo kindly sat down with us to answer our questions ranging from the vision of TPAY, the relationship with the Foundation, TokenPay’s plans for boosting crypto adoption and the promising developments in regards to their eFin decentralized exchange.

Aside from integration with the Lightning Network, what other technical and development areas do you hope the Litecoin Foundation can help TokenPay with?

Our relationships with both the Litecoin Foundation and Charlie Lee has already proven invaluable to us. For one, it provides a lot of credibilities and shows that we’re dedicated and committed to following through and realizing our primary goal, which is to increase everyday mainstream adoption of crypto.

The Litecoin Foundation is a marketing and technical partner that assists TokenPay. For example, the foundation provides direct insights regarding technical difficulties that we can avoid in our development, to trying out new technologies, sharing knowledge and facilitating direct contact with developers.

We are currently collaborating on and discussing confidential transactions, fungible coins and exchanging information regarding our future blockchain upgrades.

In light of the Litecoin development team’s plans for improving the fungibility and privacy of Litecoin, is TokenPay looking to integrate similar upgrades?

Yes, we are.

The Litecoin Foundation’s recent announcements related to Mimblewimble is something that also raises our interest. We are both learning more about the advantages, limitations and possibilities this technology can bring, especially with confidential transactions and fungible coins.

When TPAY was initially released in 2018, it incorporated the latest in privacy-focused technological advancements. It still boasts incredible 2-second transaction times and is currently being updated to a new codebase. Privacy is our primary focus on TPAY.

The upcoming EFIN coin takes it a step further by adding in a bridge functionality that will eventually let users instantly trade coins cross-chain via Atomic Swaps.

Specifically what kind of zero-knowledge proof setup does TokenPay utilize?

ZKPs are used in TokenPay’s privacy-focused stealth addresses feature. Essentially, with the DKSAP (Dual-Key Stealth Address Protocol) that we use for sending anonymous transactions, the blockchain guarantees that transactions are valid; although, information about the sender, the recipient or their history remains hidden, hence the zero-knowledge proof.

Do you see TokenPay as competition to Litecoin as a crypto asset focused on payments, and if so, how are you avoiding any consequential conflicts of interest in your partnership?

Litecoin and TokenPay have different angles to solve the same problem – adoption. While we are building an ecosystem, which provides a gateway for merchant and users to enter the crypto market, Litecoin focuses on being complementary to Bitcoin and integrated into the blockchain ecosystems. Our focus is more on consumer-facing products, and this is the reason why we find ourselves in a partnership in which we share learnings, vision as well as trying to solve adoption and reduce the complexities of the current technology.

When do you think we could see debit and/or credit cards powered by WEG Bank for Litecoin?

The CEO of WEG bank is able to provide a more accurate timeline. However, the last estimate he gave us was late 2019 or 2020. There is a lot of work that needs to be done to make this solution sustainable.

Could you describe the exact arrangement between TokenPay, TokenSuisse and the eFin decentralized exchange?

TokenPay is a decentralized self-verifying merchant payment platform that works on the TPAY blockchain. TokenSuisse is a digital assets manager that primarily caters to institutions, and also provides a crypto-to-fiat exchange solution. eFIN is a decentralized cross-chain DEX that enables users to trade cryptos safely and securely because users maintain custody of both their private keys and coins.

These three work together symbiotically to provide an end-to-end solution for merchants, institutions and users alike to be able to transact in crypto and purchase related financial products.

TokenPay directly benefits from our partnership with TokenSuisse because by introducing crypto-based financial products to institutions and retail investors, this helps to further the adoption of TokenPay. An example of this is the Privacy Coins Certificate and TPAY Tracker Certificate that TokenSuisse offers, both of which hold TPAY. When an institution or investor diversifies their portfolio and invests in either of these certificates, TokenSuisse has to buy TPAY on the open market. This provides additional liquidity and trading volume that users and merchants need to see.

In addition, after the TokenPay Merchant Platform launches, TokenSuisse will be able to provide a crypto-to-fiat exchange solution that merchants require.

Lastly, TokenPay owns the eFIN DEX. Custody and security of one’s digital assets are critical concerns for the blockchain community, even more so with financial institutions and retail investors. The DEX lets you trade securely and confidently, knowing that your transactions are completely protected. You hold your keys, you hold your coins.

The entire TokenPay ecosystem is an interconnected network that relies upon each other. For example, the EFIN coin is exclusively paired with the TPAY coin on the DEX, which further adds more trading volume and liquidity.

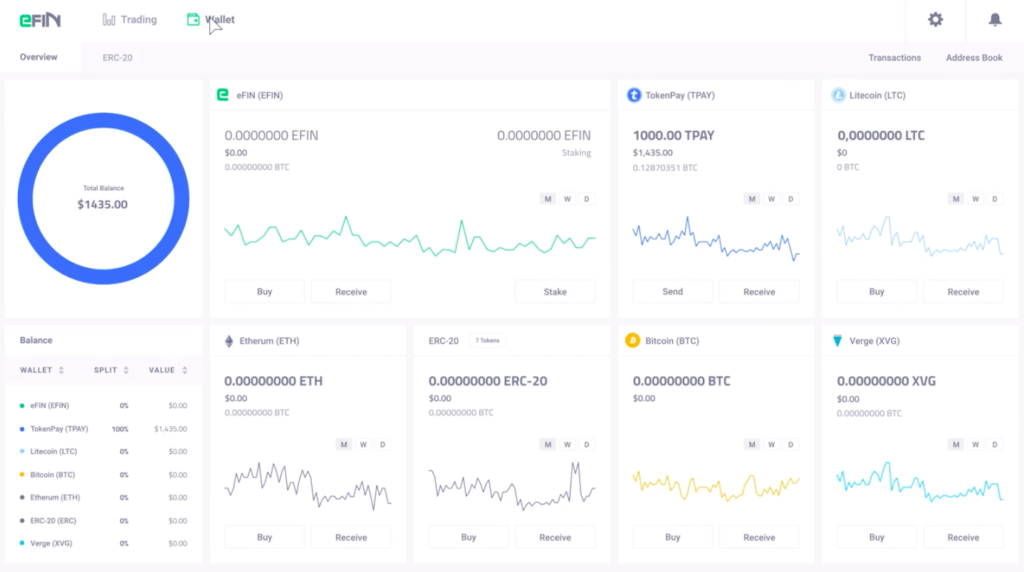

The Interface of the eFin DEX

Specifically, what is unique about the eFin DEX versus other DEXs that are currently live?

eFIN is a true decentralized cross-chain DEX. It doesn’t really have any competition. Most existing DEXs exist in-name-only. They essentially function on an IOU basis, or they’re limited to single-chain trades.

eFIN DEX technology allows users to maintain control over their private keys and coins. Users never have to trust a third party or move digitals assets from their wallets to centralized exchange wallets (and hoping that their security is adequate; something that we unfortunately know isn’t the case, as evidenced by the billions of dollars worth of crypto that has been hacked and stolen).

This way, you’re always in control of your keys and your coins. We believe this kind of peer to peer trading represents the future and is a technological vision of what the blockchain and the current market can offer in terms of security and possibilities.

Future implementations such as Atomic Swaps and the Lightning Network integration will bring even more unique characteristics to our DEX. With eFIN, our vision is to always stay at the edge of technology, learn about them, see what user issues they solve, test and integrate them in our product.

Aside from debit/credit cards and merchant processing, what other FinTech products do you hope to bring to market in the next 12 months?

We are currently working on several products that are part of the TokenPay ecosystem. The Merchant Payment Platform is 90 percent completed, and it ties into the multi-currency wallet that we’re working on that will eventually integrate with the bank. You’ll see an updated UX design for the blockchain explorer, as well.

Something that we’ve recently announced is BLAST, which is an IEO Launchpad platform that will be released soon. IEOs (Initial Exchange Offerings) are the hottest thing in blockchain right now, and we saw this coming nearly a year ago.

With BLAST, companies can launch their own blockchain project, connect it with eFIN and generate funds in TPAY.

This article by Ben Whittle was previously published on Coincentral.com

About the Author:

Ben is a crypto investor, writer & aspiring entrepreneur; who has been involved in the crypto market since April 2017. Originally a gold bug from 2013, he kicked himself when he realised what he had missed out on and ever since has been utterly obsessed with all things crypto. Currently building his own cryptocurrency focused company, he specialises in writing about macroeconomic events, scalability developments, government responses and valuation models for coins and tokens. He is sceptical of much of the ICO & ‘new generation platform’ space, preferring the ‘hard money’ coins above all else.

Featured Image Credits: Pixabay & Tokenpay