To understand cryptocurrency, you first need to understand the history of the virtual coin. Virtual coin, or digital currency, differs from traditional fiat currency in that there is no physical representation to accompany each unit of value. Long before the crypto craze of 2017, there were the pioneers of electronic cash.

These early financial freethinkers shaped the market and prepared the world for the digitization of the economy. Fast forward to today’s crypto market, and thanks to the efficiency of blockchain technology, you now see digital money experiencing increased adoption globally.

Virtual Coin Before Bitcoin

Over the last twenty years, virtual currency payment systems have flourished. These systems existed long before the advanced blockchain technology of today made virtual coins, such as Bitcoin, a household name.

Virtual currencies are not considered legal tender in most countries for many reasons. Governments do not issue these coins. Instead, virtual currencies are issued by the platform’s developers. Today, there are many ways in which companies release virtual coins. Before cryptocurrencies, bonuses were the most popular form of issuing digital currency.

Problems with Early Virtual Coin

The problem with these early virtual coins was that they were too susceptible to attack from hackers or scammers. Additionally, the lack of any form of material confirmation left many businesses skeptical of the true value behind these concepts. Remember, this was 20 years prior to the emergence of blockchain technology. Many people didn’t even own a computer at this time.

The Netherlands, the 1980s

One of the first examples of an attempt to create digital cash comes from the Netherlands in the late 1980s. Gas station owners were fed up with their businesses being robbed. The problem got so bad that someone decided it would be safer to find a way to place money onto smart cards. Trucking company owners could load these cards and give them to their drivers. The drivers would then use the cards at the participating gas stations.

Flooz.com

Another example of virtual coin usage before the cryptocurrency is the internet currency Flooz. Flooz.com issued these virtual coins in 1998 as part of a marketing campaign. Each Flooz equaled one dollar in value.

Users would receive Flooz coin for purchases made on the Flooz.com website. Users could then spend their Flooz on more products on the site, or they could take their bonus earnings and shop at numerous other participating vendors.

The concept was well before its time, and despite a multi-million dollar advertising campaign, Flooz never achieved the level of adoption required to sustain the project. The platform also took heavy losses after a combination of Russian and Filipino hackers made purchases using stolen credit cards. The company is now defunct, but the inspiration of their project lives on in the digital currencies of today.

Blinded Cash

In 1981, an American cryptographer by the name of David Chaum released his now famous paper titled Untraceable Electronic Mail, Return Addresses, and Digital Pseudonyms. Chaum described an anonymous digital currency system. In 1989, Chaum developed his protocol into a working virtual coin known as DigiCash.

The protocol was revolutionary and introduced the world to the concept of blind signatures. Blind signatures disguise the content of a message and utilize a combination of a public and private password to verify the validity of the participants. Today, this concept is used in major cryptocurrencies in the form of public keys.

B-Money

A decade after DigiCash entered the market, a developer by the name of Wei Dai made waves in the cryptographic community after publishing a paper called B-Money Anonymous, Distributed Electronic Cash System. This virtual coin concept utilized a decentralized network, which included private sending capabilities and auto-enforceable contracts. While the technical aspects of this virtual coin were far from blockchain technology, and the project never gained enough momentum to take flight, the concept greatly influenced the future cryptocurrency market.

Bit Gold

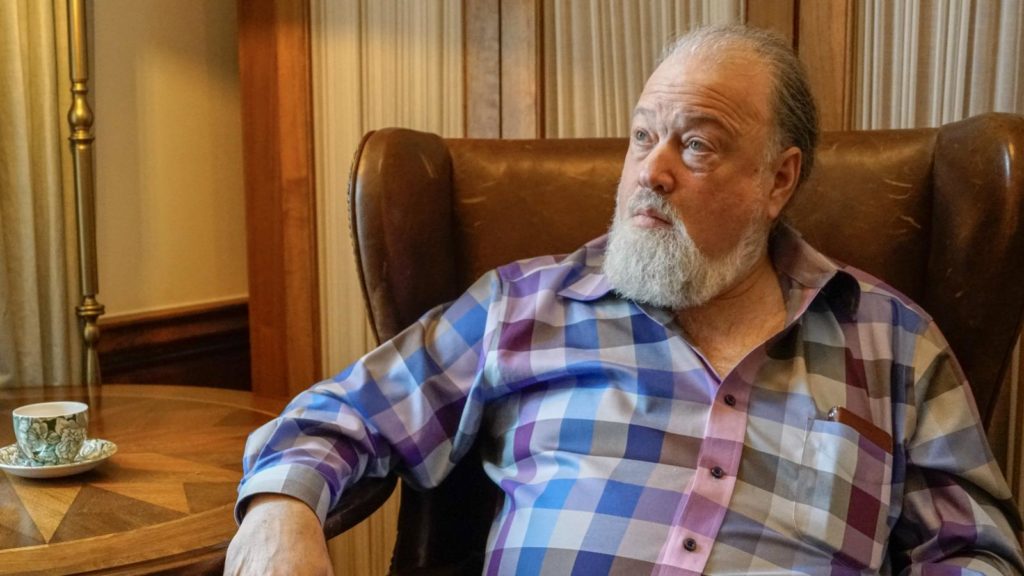

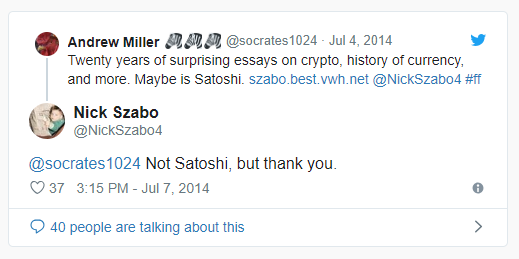

Longtime virtual coin advocate, Nick Szabo, pioneered the proof-of-work system used today by cryptocurrencies such as Bitcoin with his Bit Gold protocol. Bit Gold helped to cement the concept of a decentralized network and the elimination of third-party verification systems. Satoshi borrowed many of Bit Gold’s concepts. So much so, that many people believed Satoshi Nakamoto to be Nick Szabo. It took a public denial by Szabo to finally convince people otherwise.

HashCash

Many crypto enthusiasts consider HashCash to be the direct inspiration for Bitcoin. HashCash was introduced in 1997 by cryptographer Adam Beck. Beck incorporated a proof-of-work protocol to verify the validity of a transaction. HashCash’s proof-of-work protocol previously saw use as a spam reduction technique before being adapted for virtual coins. The concept impacted Nakamoto to the point that he cites Beck in the Bitcoin white paper. However, HashCash lost relevance after suffering scalability issues due to increased network congestion.

Enter Bitcoin and the Wonders of Blockchain

Satoshi Nakamoto, the anonymous creator of Bitcoin, labels the world’s most successful cryptocurrency as “a peer-to-peer electronic cash system.” Unlike the virtual coins before Bitcoin, Satoshi had the backing of powerful new technology, blockchain.

Blockchain technology stores information in duplicate over a vast network of computers. Prior to any changes to the blockchain, fifty-one percent of the nodes must agree on the validity of the chain. This validation process references the previous blocks. The longest verifiable chain of transactions remains the valid chain. In this manner, blockchain technology eliminates the need for third-party verification systems such as banks.

Advantages of Virtual Coins

The advent of blockchain technology increased the benefits of virtual coins significantly. Users can transfer cryptocurrency in near-instant time, and at a much cheaper rate than the traditional methods of global money transfer. Cryptocurrencies eliminate the need for verification systems, which saves you big time.

To put the level of savings experienced by crypto users into perspective, look at the traditional international money transfer methods. Today, your funds require verification from potentially thirty-six different third-party organizations when sent globally. And, each organization tacks on a fee for their services.

Virtual Coins Are Here to Stay

Now, the world has multiple legitimate virtual currency options to consider. These digital currencies continue to shape the economics of the future. Today, virtual coins are more common than ever, and for the first time in history, digital money receives recognition from traditional financial firms.

This article by David Hamilton was previously published on Coincentral.com

About the Author:

David Hamilton aka DavidtheWriter has published thousands of cryptocurrency-related articles. Currently, he resides in the epicenter of the crypto market – Puerto Rico. David is a strong advocate for blockchain technologies and financial sovereignty. (His website: http://Mywebalien.com)