With a 5.1% APY on BTC, the BlockFi Interest Account seems like a ray of sunshine for digital asset holders that have grown used to having their holdings slosh around with market volatility. Let’s explore in our BlockFi review.

The BlockFi Interest Account:

- It allows users to earn competitive compound interest rates on their cryptocurrency (currently BTC, ETH, and GUSD).

- Keeps cryptocurrency deposits secure. BlockFi’s cryptocurrency deposits are held by the Gemini Trust Company, regulated by the New York Department of Financial Services.

- It is available worldwide, outside of sanctioned or watchlisted countries.

- Allows for anytime withdrawals. Users get one free withdrawal per month.

- It offers simple and easy registration.

The BlockFi Interest account is the only cryptocurrency storage option that pays substantial interest and offers rates that are competitive with most non-crypto currency interest rates. For example, high-interest savings accounts Ally Bank (1.6%) and WealthFront (1.82%) pale in comparison, although they are FDIC-insured, whereas BlockFi’s cryptocurrency deposits are not.

BlockFi also offers loans backed by your cryptocurrency with a 50% LTV ratio. The following BlockFi review and interview are specifically for the BlockFi Interest Account, and not for the loan products.

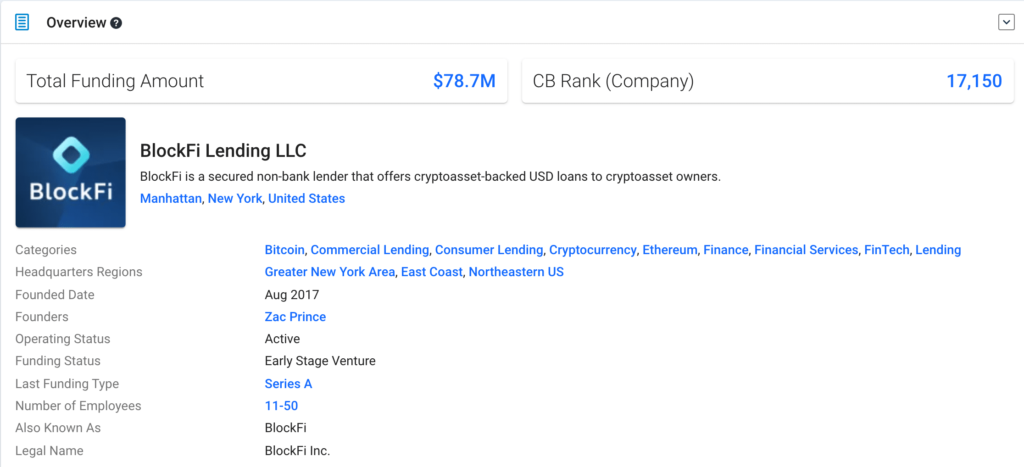

About BlockFi

BlockFi is a privately-held NYC-based lending platform founded in 2017.

The BlockFi Team

BlockFi’s leadership team has decades of experience in the traditional financial services and banking world, and the company claims to take a conservative approach to regulation that will position it for sustainable long-term growth and expansion.

Founder & CEO, Zac Prince has experience in leadership roles at multiple successful tech companies. Prior to starting BlockFi, he led business development teams at Orchard Platform, a broker-dealer and RIA in the online lending sector, and Zibby, an online consumer lender.

Co-Founder & VP of Operations Flori Marquez has experience managing alternative lending products. In the marketplace lending industry, she helped build, scale, and optimize a $125MM portfolio for Bond Street (acquired by Goldman Sachs). As Head of Portfolio Management, Flori managed all operations from point of origination through to default and litigation.

Chief Risk Officer, Rene Van Kesteren spent over 15 years at BAML as a Managing Director of ML Professional Clearing / Prime Brokerage. During his time there, he built the equity structured lending platform, including risk and regulatory compliance frameworks. Prior to BAML, Rene worked as an equity derivatives trader in Caxton’s Strategic Quantitative Investment Division.

BlockFi Funding

BlockFi recently raised $18.3 million in Series A funding led by Valar Ventures (Peter Thiel-backed) with participation from Winklevoss Capital, Galaxy Digital, ConsenSys Ventures, Akuna Capital, Avon Ventures, Susquehanna, CMT Digital, Morgan Creek, and PJC.

BlockFi on Crunchbase

BlockFi has also raised earlier rounds by SoFi and Purple Arch Ventures.

The team notes that they anticipate raising additional capital in the future to facilitate continued product development and rapid growth.

BlockFi Review: BlockFi Interest Account Review and Interest Rates

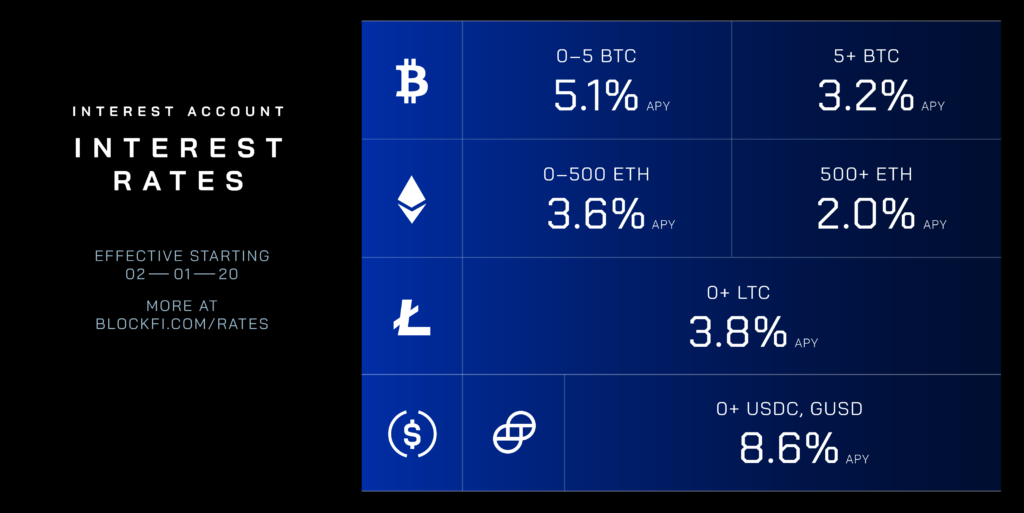

The BlockFi interest rates are fairly competitive, especially when compared to simply keeping your cryptocurrency on an interest-free exchange or wallet.

- Bitcoin: Users can earn up to 5.1% in annual interest on deposits under 5 BTC, and 2.2% on any BTC amount above that 5 BTC threshold.

- Ethereum: Users can earn up to 3.6% in annual interest on deposits under 500 ETH, and then 0.5% on amounts over that 500 ETH threshold.

- Litecoin: Users can earn up to 3.8% in annual interest on all deposits.

- Gemini Dollars: Users can earn a whopping 8.6% interest on their GUSD deposits.

- USDC Dollars: Users can earn a whopping 8.6% interest on their USDC deposits.

The interest rates are paid in their nominal cryptocurrency. For example, you will earn 0.062 BTC on 1 BTC in a full year, provided the interest rate stays the same. This is a double-edged sword, of course, but if you’ve been in the cryptocurrency space for a while you’re no stranger to the pros and cons of owning a volatile asset. Your 0.062 BTC could either be more or less than its USD equivalent at the time of deposit, so plan accordingly.

However, earning 8.6% on a stablecoin such as Gemini Dollar eliminates some of the volatility risks. $10,000 in GUSD will earn you $860 in GUSD for the full year, and since it’s pegged to the U.S. Dollar, you won’t have to be concerned about its price being drastically different (provided something catastrophic doesn’t happen to Gemini or its GUSD.)

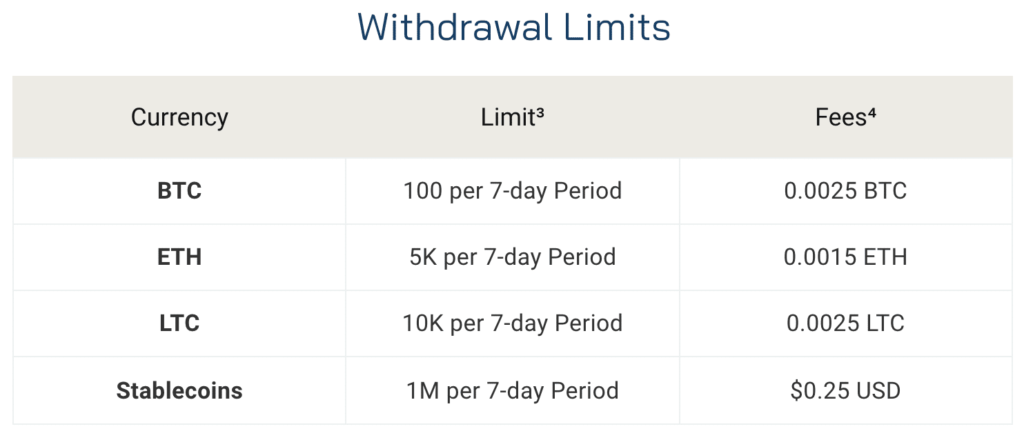

Please note that BlockFi charges flat withdrawal fees. which are subtracted from the total withdrawal amount. Users get 1 free withdrawal per month.

How Does BlockFi Make Money?

At its roots, BlockFi is a spread business that makes money by borrowing capital at a certain rate (the interest rates it pays to users) and lends it a higher rate (the interest rates it offers for BTC/ETH/GUSD loans).

A BlockFi blog post notes that the company primarily works with institutional counterparties to offer them liquidity. These borrowers consist of:

- Traders and investment funds seek arbitrage trading opportunities in a fragmented marketplace. They borrow cryptocurrency to close mispricing gaps between exchanges or dispersed markets. Margin traders will borrow to fuel their trading strategies.

- Over the counter (OTC) market makers that connect buyers and sellers that prefer not to transact over public exchanges, often at a steep mark-up. These parties need to keep cryptocurrency inventory on hand to meet demand. Since owning the cryptocurrency is very capital intensive and bears the risks of price volatility, OTC market makers will borrow from lenders such as BlockFi to facilitate their needs.

- Other businesses need an inventory of cryptocurrency to provide their clients with liquidity. This category includes businesses such as cryptocurrency ATMs that keep the majority of their cryptocurrency assets in cold storage and need some level of liquidity to function on a daily basis.

Is BlockFi Safe?

Based on our research and conversations, BlockFi passes the safety test. Well, it’s about as safe as Gemini, its primary custodian. Gemini keeps 95% of its assets in cold storage and 5% in hot wallets that are insured by Aon.

Gemini is a licensed custodian and regulated by the NYDFS, and it recently received SOC2 compliance from Deloitte for its custody solution.

While BlockFi’s interest rates are appealing, it’s natural for cryptocurrency aficionados to be skeptical– and rightfully so, we tend to be a paranoid breed. That’s what this Blockfi review is for!

What happens to user funds during each of these scenarios? How are they protected?

Even if we trust a business, which there is little to indicate BlockFi can’t be trusted, the doomsday “what ifs” hold primary real estate in our brains.

We talked doomsday with the BlockFi team:

BlockFi gets hacked?: “Gemini is BlockFi’s primary custodian and BlockFi doesn’t hold private keys directly. Gemini keeps the vast majority of its assets in cold storage and is insured by Aon. Gemini is a licensed custodian and regulated by the NYDFS. They recently received SOC2 Type 1 compliance audit from Deloitte for their custody solution. We encourage users to read more about Gemini’s security. “

A user account is compromised?: “Since inception, BlockFi has not lost any customer funds. In the event that a user’s account is compromised, which our security protocols have caught in the past, we freeze the individual’s account for one week. Then, we conduct a Videoconference with the affected individual to verify their identity. We can then change their email address and password, so they can regain control of their account.”

Suddenly everyone defaults on their loans?: “When we lend crypto assets to generate yield, we have an extremely thorough risk management and credit analysis process. We only primarily lend to large, well-capitalized, institutional borrowers, or to counterparties willing to post collateral and provide the ability to margin call them on a 24/7 basis.”

“What that means is, if we are lending $1M worth of BTC to Firm XYZ, Firm XYZ collateralizes the loan (typically ~120%) by giving us ~$1.2M USD. If the loan were to then enter margin call and the borrower was unable to provide additional collateral (default), we would use their USD collateral to buy crypto.”

“We have actively lent since January of 2018, including throughout multiple periods of high volatility, without any losses across our entire lending portfolio. BlockFi is bound by NDA’s to discuss terms of specific borrowers/rates.”

How do I apply for a BlockFi Account?

Signing up for a BlockFi account is fairly effortless and can be done in under two minutes.

- You can start right from this BlockFi review. Go to the BlockFi website.

- Go to the “Earn Interest” option in the homepage slider, or “Get Started” in the menu.

- Enter your email and make a password to create your account.

- Enter the verification code sent to that email.

- Once logged in, select “Deposit” to verify your identity and make your first deposit.

- Enter your personal information for verification (part 1)

- Upload a form of ID such as a passport, driver’s license, or ID card and wait to be approved.

How do I get in contact with BlockFi Customer Service?

If you’d like to contact BlockFi customer service, you can reach them at [email protected].

So far, BlockFi support has been well above average. Let us know how your experience went was any different!

BlockFi Interview

How is offering a 5.2% on BTC interest rate sustainable?

“The interest we are able to pay is based on the yield that we are able to generate from lending, which directly correlates to the market demand in the space (I.e. what rate institutions are willing to pay to borrow specific crypto assets, as it varies from asset to asset). We are bound by NDAs to discuss specifics (institutions, specific rates, etc).”

How about the 8.6% interest rate on Gemini Dollars? Can you talk about why Gemini?

“We are able to use stablecoin deposits to fund our consumer loans (average APR is ~10-13%) so we can afford to pay higher interest to GUSD / Stablecoin depositors.”

The BlockFi interest rate is subject to change on a monthly basis, could you explain why this is?

“Upcoming changes are announced typically 1-2 weeks prior to a new month, giving clients ample notice and time to prepare. The interest we are able to pay is a function of the borrowing demand.

To date, our top-tier BTC interest rate and GUSD interest rate have not changed. You can read more about why our rates are variable and how the lending market works here.

What happens in the case of a BTC/ETH fork? Will a user’s balance be credited with the forked coin as well?

“Gemini is our custodian and has all of the information about what happens in the case of a forked network. Please refer to their user agreement here where you can read more about that.”

What does the future look like for BlockFi? How will this BlockFi Review be different in a year?

“We’re confident that we will become a very large and successful company that provides financial services on a global scale to the benefit of millions of clients. We plan on going through three distinct growth phases based on our addressable market and products:

- Phase 1

- Products for people who already own Bitcoin or another crypto asset that’s supported on BlockFi’s platform

- Ability to earn interest borrow USD secured by your crypto

- Phase 2

- Expand the addressable market to include people who don’t own cryptocurrency yet.

- Launch the ability to buy and sell on the platform and payments category products like a Bitcoin rewards credit card

- Phase 3

- Focus on global expansion and expand the addressable market to include users that may not ever want to own crypto

- Heavily utilize stablecoins to provide traditional banking products on blockchain rails

Final Thoughts: Is BlockFi Legit? Is BlockFi Worth It?

All of our indicators for this BlockFi review (history, team, communication with support, and business model evaluation) point to yes: BlockFi is legit. There is very little evidence that suggests otherwise. There are a handful of negative reviews online from disgruntled users, but they mostly seem to be rooted in misunderstanding (ie. assuming the interest was paid in USD and not in BTC/ETH/GUSD).

Whether or not BlockFi is worth it comes down to your risk profile and what you’re doing with your cryptocurrency.

If it’s just sitting on an exchange, you may as well reap the benefits of compounded interest. 10 BTC would turn into 10.62 BTC in a year, a not insignificant gain of around $5,000 for the year. You would also receive the benefits or tragedy of Bitcoin’s price going up or down.

However, it’s worth remembering that any time your cryptocurrency leaves your hard wallets, it’s exposed to a higher degree of risk. If BlockFi or Gemini were to experience some (highly unlikely) catastrophic hack, your cryptocurrency would be at risk.

Our BlockFi review comes back positive. After speaking with team representatives, and with their support team on the client-side, we look forward to seeing BlockFi establish itself further in the space. Projects such as BlockFi simply existing provide cryptocurrency investors a much-needed diversification of revenue streams, something that die-hard HODLers have missed through the past few years.

Editor’s Note/disclaimers: None of the above isn’t investment advice and is purely educational and entertainment.

The original article by Alex Moskov was previously published on Coincentral.com

About the Author:

Alex is the Editor-in-Chief of CoinCentral. Alex also advises blockchain startups, enterprise organizations, and ICOs on content strategy, marketing, and business development. He also regrets not buying more Bitcoin back in 2012, just like you.